VIA PR Newswire

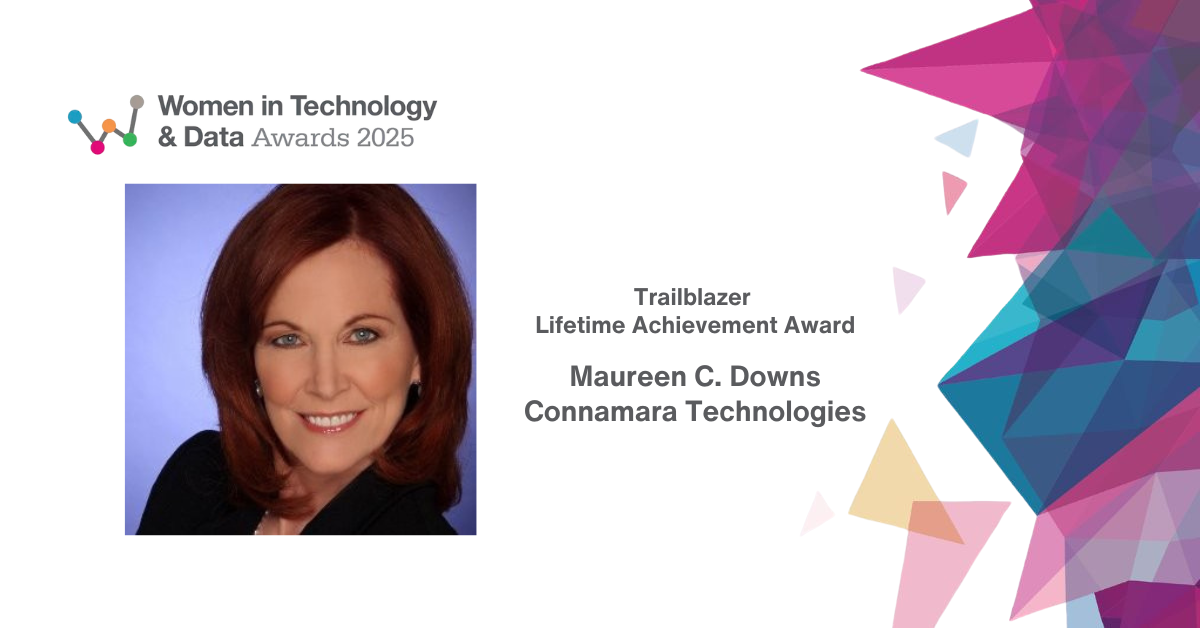

LONDON – Connamara Technologies, a leading provider of exchange technology, announced that co-founder and chair Maureen C. Downs was honored with the “Trailblazer Lifetime Achievement Award (vendor)” by WatersTechnology at the Women in Technology and Data Awards in London on March 7, 2025.

This award was presented to the candidate who has “affected change within her organization and has acted as a mentor for female colleagues and women in general.”

For 30 years, Maureen has been a trailblazer in capital markets and financial technology. She has served in key leadership roles at brokerages, trading firms, trade associations, and regulatory bodies, including two terms as the first woman Chair of the National Futures Association, the self-regulatory body for the U.S. derivatives industry, from 2020-2024.

In 2022, Maureen co-founded Connamara Technologies, Inc. Under her leadership, Connamara developed and launched EP3®, an end-to-end exchange and clearing platform that is asset-agnostic, cost-accessible, and quick-to-market. EP3 is powering new exchanges and marketplaces across the globe.

Maureen was one of 125 freshman women selected for admission to a student body of over 6,000 men when the University of Notre Dame first began admitting female students. She graduated summa cum laude and 1st in the College of Business. Subsequently, she pursued careers as a Certified Public Accountant and Attorney at Law at a time when women represented only a small fraction of the professionals at most major firms. Maureen rose to prominence in the U.S. derivatives industry – an industry that, to this day, remains largely male-dominated.

Chosen from a group of accomplished women in the capital markets and financial technology industry, Maureen’s achievements are something that Connamara Technologies is proud to celebrate.

WatersTechnology is a leading information source for technology trends in capital markets. For a complete list of winners, click here.

About Connamara Technologies

Connamara Technologies is the leading provider of fully-integrated exchange infrastructure, empowering new and existing exchanges to operate with exceptional efficiency and reliability. Its EP3® platform is a new breed of exchange and clearing technology that seamlessly integrates all key functions into a single, robust platform. It is cost-accessible, adaptable, scalable and quick-to-market. Engineered for the evolving needs of the next generation of exchanges and marketplaces, EP3 is shaping the future of financial markets.

To learn more, please visit www.connamara.tech or connect on LinkedIn

For media inquiries, please contact:

Contact

Daniel Davis, Head of Growth

[email protected]